non filing of income tax return

To avoid this all individuals should speedily clear their income tax dues. Philippine Daily Inquirer 0506 AM November 11 2021.

Affidavit Of Non Filing Of Income Tax Pdf Affidavit Payments

In the disqualification case is that his conviction for violation of the Tax.

. An Income Tax Return is mandatorily required to be filed if the Total Income is more than the minimum amount which is exempted from the levy of tax. In addition to non-filing of the income tax returns within the due dates if the specified person does not furnish PAN to the payer then the TDS rate shall be higher of the. WASHINGTON The Internal Revenue Service today encouraged taxpayers to take simple steps before the end of the year to make filing.

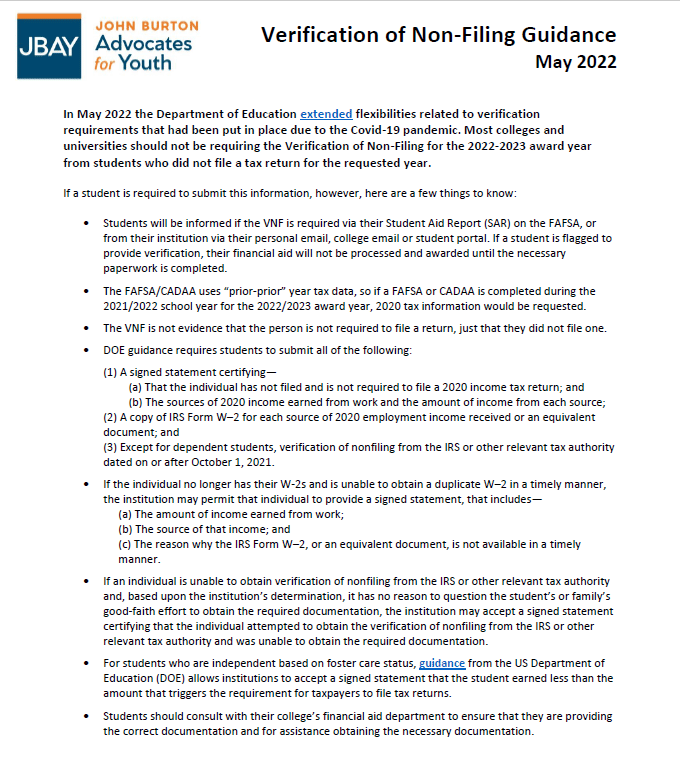

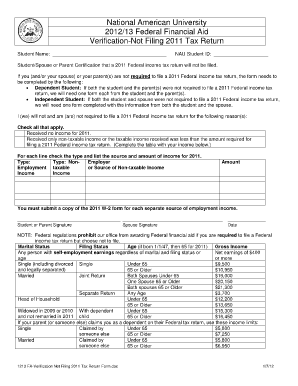

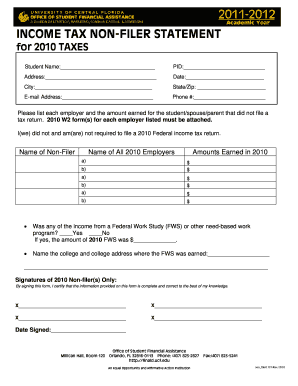

Although ITR is not required to be. Visit the IRS website to access the Non-filer form. If both are nontax filers each must submit a Verification of Non-filing Letter.

The minimum penalty for failing to file within 60 days of the due date 210 or 100 percent of your unpaid taxes whichever is less. Non-filers of Income Tax returns should know that the new TDS rates applicable for them will be double the regular tax rates. Nonresident Spouse with no Vermont Income.

In conclusion if an income tax return is not filed citizens and businesses are likely to pay a penalty. Verification of Non-filing Letter from the IRS. As a general rule taxpayers are required to use the same filing status for their Vermont income tax return as they do on their federal return.

Income tax return is the form in which assessee files information about hisher income and tax thereon to Income Tax DepartmentVarious forms are ITR 1 ITR 2 ITR 3 ITR 4 ITR 5 ITR 6. We have identified clients of tax agents whose 2021 IR3 IR3NR or IR4 income tax returns have not yet been filed and late filing penalties have been applied to. The next page will display the form you need to fill up for payment.

Corporate income tax returns. The principal defense of Ferdinand R. IR-2022-203 November 22 2022.

If you are paying the penalty for not filing ITR as an individual taxpayer choose 0021 Income Tax. Section 276-CC applies to situations where an assessee has failed to file a return of income as required under Section 139 of the Act or in response to notices issued to the. Either form 1120 or form 7004 must.

The Income Tax Appellate Tribunal ITAT Mumbai Bench has recently in an appeal filed before it while upholding the reassessment under section 147 of the Income Tax. For submitting the corporate tax returns for income gained in 2020 the deadline is until April month 15 2021. Scroll to the bottom of this IRS portal.

Any person who attempts to make it appear for any reason that he or another has in fact filed a return or statement or actually files a return or statement and subsequently withdraws the. Or other relevant tax authority dated on or after October 1 2022. In this case the assessee firm neither filed its voluntary return of income Section 139 of the Income Tax Act nor filed a return despite notices Sections 142 and 148 of the.

The CBDT has extended the deadline for submitting the TDS Return Statement in Revised Updated Form 26Q relating to non-salary deductions of tax at source for the. The two new sections introduced in the Finance bill. The table below lists the software authorized by Revenu Québec that may be used by professional tax preparers to file the personal income tax return TP-1-V.

The failure-to-file penalty grows every month at a set rate.

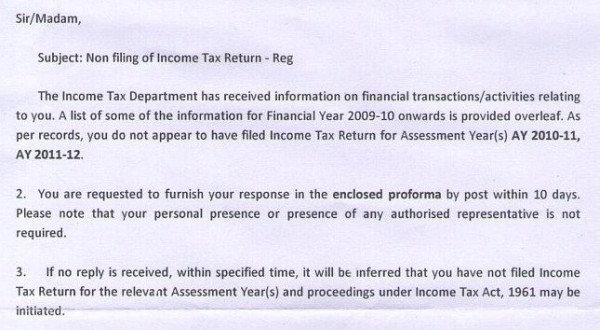

Non Filling Of Income Tax Return Cib 321 Income Tax Notification

Penalty For Late Filing Of Income Tax Return Ebizfiling

Not Filing Your Income Tax Returns On Time You Could Be Prosecuted Rahul Jain Nangia Andersen India Pvt Ltd

What Happens If Itr Is Not Filed What Are The Consequences

Affidavit Of Non Filing Of Income Tax Pdf Affidavit Payments

Dct Rpqa Dct Rpqa Added A New Photo

Accurals Accounting Management Solutions Taxpayers Who Do Not File Their Income Tax Return On Time Can Be Subject To Penalty And Charged An Interest On The Late Payment Of Income

Verification Beyond The Basics Ppt Download

Explained All About Belated Filing Of Income Tax Returns

Irs Verification Of Non Filing Letter Jbay

Filing A 2020 Tax Return Even If You Don T Have To Could Put Money In Your Pocket Internal Revenue Service

Income Tax Non Filing Letters From Rita Mailing This Week City Of Mentor Ohio

How To Fill Out The Irs Non Filer Form Get It Back

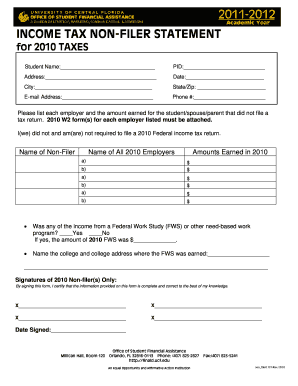

Non Filing Tax Form Fill Online Printable Fillable Blank Pdffiller

What Will Happen If I Do Not File My Income Tax Return Itr Tax2win Blog

Unfiled Tax Returns And Irs Non Filing Rush Tax Resolution

Filer Form Fill Online Printable Fillable Blank Pdffiller

Previous Years Non Filed Tax Returns Genesis Tax Consultants

How To Apply For The Child Tax Credit With The Irs Non Filer Sign Up Tool Youtube